The Impact Of Economic Policy On Kentucky

Kentucky’s major industries are manufacturing, mining, agriculture, and tourism.

Kentucky produces oil and natural gas, but hard coal remains the state’s “principal” mineral. It is believed that Kentucky’s coal, as well as the fuel cells produced by the state’s only uranium enrichment plant for nuclear power plants in the United States, produce nearly a quarter of the United States’ electricity.

Kentucky’s industry is mostly concentrated in the northern part of the state, along the Ohio River, where most of Kentucky’s population lives. The state’s auto industry is very well developed, with the state ranking fourth in the United States in the number of assembled vehicles, accounting for more than 10% of U.S. auto production. Kentucky plants assemble Fords, Chevrolets, Caddies, and Toyotas.

In The State Produce

Electric Machines

Provides more than 10% of U.S. auto production.

Foodstuff

Provides more than 5% of U.S. Foodstuff.

Clothes

Provides 18% of U.S. clothes production.

Printed Matter

Provides more than 20% of U.S. Printed Matter.

Brands That Trust Us.

The famous online casino ggbet bonus: criteria for evaluating licensed online entities

Experience the thrill of flight with the Aviator Game Download for Android, iOS, and PC.

In case you are in need of writing assistance for the Economics thesis check out A*help’s list of 20 dissertation writing services. These sites specifically state that they are pros in disseration&thesis writing.

Are you looking for new opportunities? Try the trusted non UK casinos, where players from all over the world have immense freedom in their favourite activities.

The Fit Father Project: weight loss and fitness program for busy dads. Created by Dr. Anthony Balduzzi. Meal plans, workout plans, supportive Facebook group, and bonuses. Flexibility for middle-aged men, promoting healthy eating and muscle building. Learn more in Fit Father Project review

Learn different branches of economics for better understanding the whole subject. Getting help with economics homework online from hw helpers that take a significant part in economics assignment help.

Legal alcohol limit in Missouri is 0.08% which is equal to most of the states.

The Parimatch betting app offers a seamless and user-friendly interface for convenient and enjoyable sports betting.

Introducing free local dating sites – DoULike that connects you with singles in your area. No more endless swiping through profiles of people thousands of miles away. With DoULike, you can find potential matches in your city or town.

About Economic

The Impact Of Bourbon Production On Kentucky’s Economy

News/Economic

Tourism is an important part of the state’s economy.

Kentucky jokes, “Bourbon, horses, and cigars are what draws tourists to the “bluegrass state” (though, of course, besides bourbon and horse racing, Kentucky is also interesting for its unique natural sites, such as Mammoth Cave), as well as numerous historical sites.)

More About The Economy

News/Economic

In 2003, Kentucky’s GDP was $129 billion. The state’s most important minerals include hard coal, natural gas, and oil.

The state’s industry is concentrated along the Ohio River. Food processing, textiles, tobacco, machinery, iron and steel products, motor vehicles, electronics, furniture, shoes, liquor, and chemical plants are the most developed industries in the state.

What people say

What the locals say about Kentucky’s economy

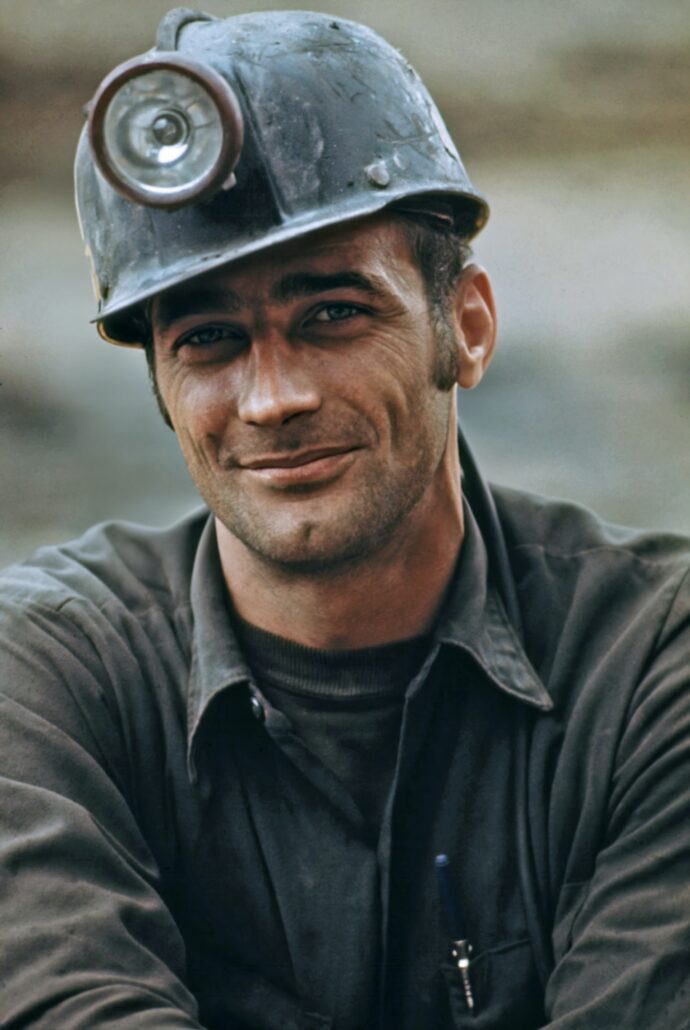

Mineral Extraction

As a local Kentucky resident, I am pleased to see the development of mineral mining in our region. Kentucky is known for its abundant natural resources, and the development of this industry has a positive impact on our state’s economy. Mineral mining creates new jobs and attracts investment to our area. At the same time, it is important to strike a balance between industrial development and environmental preservation. It is my hope that our area will continue to benefit from the sustainable development of mineral extraction by complying with the necessary standards and environmental protections.

Jeremy J. Carper

Miner

Restaurant Business

I’m excited to see the growth and development of the restaurant business in our region. It brings many benefits to our community by providing a variety of dining options and creating new jobs. Restaurants are becoming places where people can enjoy local food and spend time with family and friends. In addition, the development of the restaurant business contributes to economic growth and attracts tourists to our area. I hope this trend continues and we will have even more great restaurants and culinary experiences in our beautiful Kentucky.

John R. Kinzel

Restaurant Administrator

News

-

Kentucky’s Eerie Hillside Towns: Ghostly Discoveries

In the shadow of Kentucky’s ominous hills lies a world of mysterious towns whose narrow streets and abandoned houses seem to invite us on a journey through the shadows of the past. Under the cover of darkness and mystery, ghostly discoveries are revealed, shrouding the region in riddles and legends. We’ll travel deep into forgotten […]

-

Kentucky’s Entertainment Revolution: A Journey through Time and Tomorrow

In the heart of America, amidst picturesque hills and majestic valleys, a remarkable story is unfolding. Kentucky, famous for its prairies and cowboy legends, is now entering a whole new era of entertainment. It’s not just an evolution, it’s a true revolution, transporting us through time and space. Welcome to a world where the past […]

-

The Changing Landscape of Business Education in the Era of Big Data

The significance of Big Data can hardly be overstated in today’s rapidly transforming business environment. Characterized by its incredible volume, velocity, and variety, Big Data has become an indispensable asset for companies striving to achieve competitive advantages through informed decision-making. This data-driven revolution has necessitated a corresponding metamorphosis in business education, where future leaders are […]

Kentucky’s Eerie Hillside Towns: Ghostly Discoveries

In the shadow of Kentucky’s ominous hills lies a world of mysterious towns whose narrow streets and abandoned houses seem to invite us on a journey through the shadows of the past. Under the cover of darkness and mystery, ghostly discoveries are revealed, shrouding the region in riddles and legends. We’ll travel deep into forgotten […]

Kentucky’s Entertainment Revolution: A Journey through Time and Tomorrow

In the heart of America, amidst picturesque hills and majestic valleys, a remarkable story is unfolding. Kentucky, famous for its prairies and cowboy legends, is now entering a whole new era of entertainment. It’s not just an evolution, it’s a true revolution, transporting us through time and space. Welcome to a world where the past […]

The Changing Landscape of Business Education in the Era of Big Data

The significance of Big Data can hardly be overstated in today’s rapidly transforming business environment. Characterized by its incredible volume, velocity, and variety, Big Data has become an indispensable asset for companies striving to achieve competitive advantages through informed decision-making. This data-driven revolution has necessitated a corresponding metamorphosis in business education, where future leaders are […]

Universal Basic Income: An Educational Perspective on Economic Security

Universal Basic Income (UBI) has emerged as a pivotal discourse in contemporary politics and economics, captivating the imagination of social scientists, politicians, and the general populace alike. At its core, UBI is a radical rethinking of social welfare policy—one that stipulates a periodic, unconditional payment delivered to all citizens as a right of citizenship. Ostensibly […]

Kentucky’s Development and Economic Growth: A Promising Future

The state of Kentucky, located in the southeastern region of the United States, has been making significant strides in terms of its development and economic growth in recent years. With its rich history, diverse landscapes, and vibrant culture, Kentucky has managed to attract attention and investment, leading to a thriving economy that promises a bright […]

The Impact Of Bourbon Production On Kentucky’s Economy

Tourism is an important part of the state’s economy. Kentucky jokes, “Bourbon, horses, and cigars are what draws tourists to the “bluegrass state” (though, of course, besides bourbon and horse racing, Kentucky is also interesting for its unique natural sites, such as Mammoth Cave), as well as numerous historical sites.) Kentucky is the birthplace of […]

More About The Economy

In 2003, Kentucky’s GDP was $129 billion. The state’s most important minerals include hard coal, natural gas, and oil. The state’s industry is concentrated along the Ohio River. Food processing, textiles, tobacco, machinery, iron and steel products, motor vehicles, electronics, furniture, shoes, liquor, and chemical plants are the most developed industries in the state. The […]

Agriculture, Forestry, and Fishing

Until the mid-20th century, Kentucky was considered an agricultural state. Since that time, other sectors have overtaken agriculture as the primary contributors to the state’s gross product. However, while the number of farms and the acreage devoted to agriculture have declined, average farm size has increased, and more than half of the state is still […]

Transportation

Cincinnati/Northern Kentucky International AirportInterstate highways crisscross Kentucky from north to south and east to west. They are complemented by a system of parkways, U.S. highways and state highways that make traveling by car or truck relatively easy almost anywhere in the state. Rail lines connect all major cities for freight transportation. Large shipments are often […]

Resources and power

Kentucky’s vast reserves of bituminous coal have enabled it to remain one of the nation’s leading coal producers for many years. Coal is mined in the Western Coal Region and in the eastern Mountain Region. Western Coal produces a product with a high sulfur content that is used primarily for steam power generation and for […]

Education

Kentucky’s first school was founded in Harrodstown (now Harrodsburg) in 1775. Education was free and compulsory for ages 7 to 16. State taxation to support education was first introduced in 1904. In 1990, the Kentucky General Assembly passed the Kentucky Education Reform Act (KERA), a landmark piece of legislation that primarily provided equal funding for […]

Let’s get Contact!

Contact with us. We will get back to you soon.